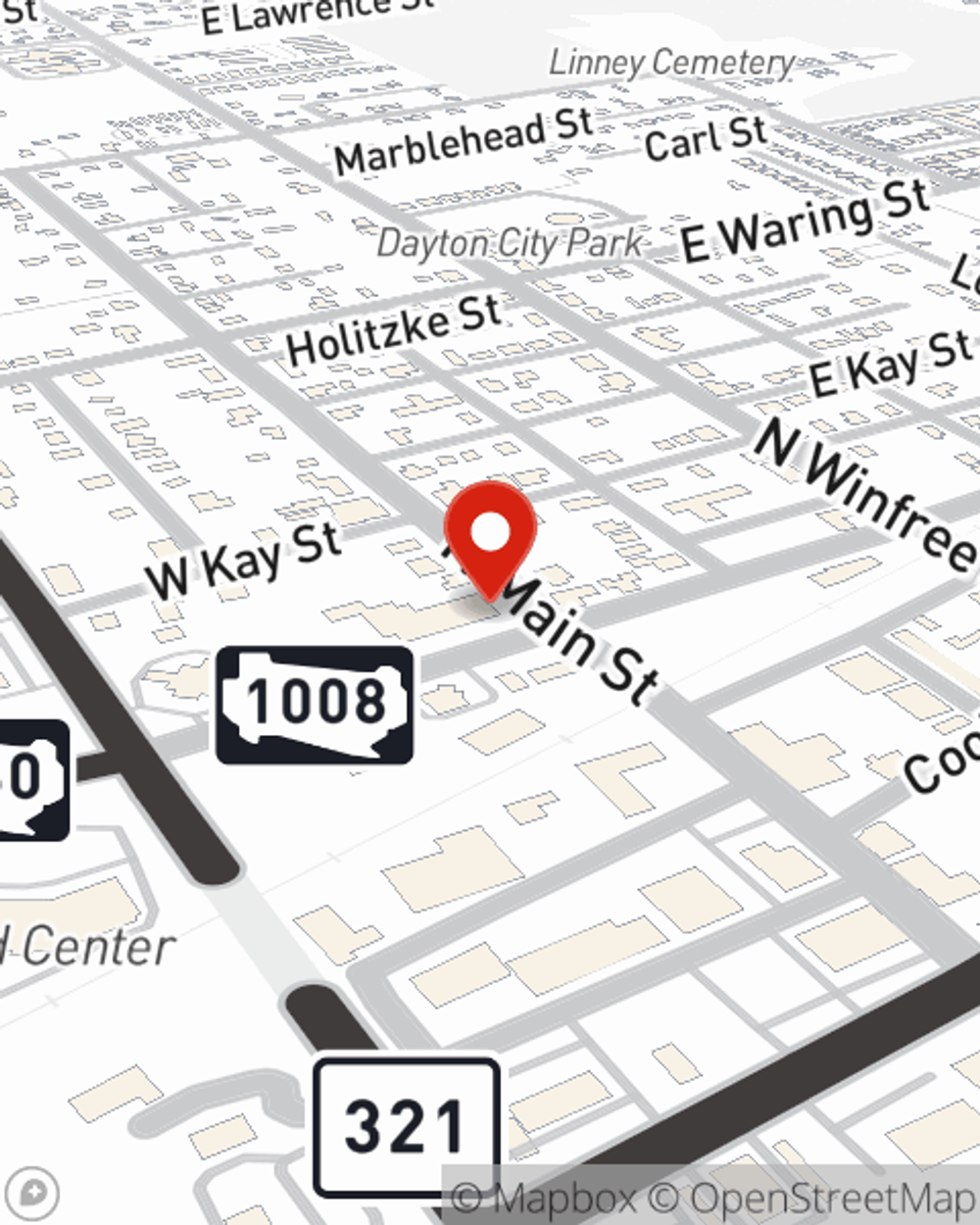

Business Insurance in and around Dayton

One of the top small business insurance companies in Dayton, and beyond.

Almost 100 years of helping small businesses

Insure The Business You've Built.

Running a small business is no joke. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, trades, contractors and more!

One of the top small business insurance companies in Dayton, and beyond.

Almost 100 years of helping small businesses

Cover Your Business Assets

When one is as driven about their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for commercial auto, commercial liability umbrella policies, business owners policies, and more.

Let's talk business! Call Randel Arnold today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Randel Arnold

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.